A fixed asset is a long-term piece of property that is used in the production of income, such as office equipment, machinery, vehicles or real estate. Considering that fixed assets are normally some of the largest and most important investments a company makes, one would think that they would always be accounted for, both tangibly and on the general ledger. Yet, a shocking 12 to 25% of the assets in a fixed asset ledger don’t exist. These are known as ghost assets, and they are a hidden drag on small businesses that don’t properly account for and dispose of them.

If you’re unfamiliar with ghost assets, you’re not alone: 49% of the small business owners or managers polled in the Wasp Barcode Small Business Accounting Report admitted they didn’t know what ghost assets were; another 25% said they didn’t know how ghost assets impacted their financial books.

Ignorance can be a killer for these small businesses, on average, one-quarter of all related financial, insurance and tax benefits created are related to ghost assets, meaning that their bottom line is greatly altered by what is essentially false or poor accounting practices. Learning what ghost assets are, how to get rid of them, how to be proactive about avoiding them, and the benefits to organized, ghost-free asset ledgers is crucial to staying in business.

What is a ghost asset?

By definition, a ghost asset is a fixed asset that can’t be accounted for because it is physically missing or otherwise rendered unusable, perhaps after breaking down. Other reasons for the appearance of ghost assets include unrecorded trade-ins, using parts of existing machines to repair broken units, and factory rearrangement with what were thought to be “unneeded” items that have been scrapped. Despite disappearing, or fully depreciating, or falling out of use, ghost assets still count towards a company’s tax and insurance liability.

What are the benefits of removing ghost assets?

To understand ghost assets, consider a few examples: A computer that became outdated for your needs, so you donated it to a local school; a trailer at a worksite that goes missing due to a problematic (and likely manual) asset management system; a telephone system that was replaced; an addition to a warehouse that involved tearing down an old common wall, with no accounting entry made for the loss of the partial structure. Some ghost assets are less obvious, and thus easier to overlook, than others. Few business owners are knowledgeable enough about taxes and finance to always consider how an upgrade, donation, or investment for your business can result in the creation of new ghost assets.

If you’re only just becoming aware of the ghost assets on your books, and learning that they are common for all companies, you may wonder if removing them is worth the effort of tracking them down and writing them off. But the financial and legal benefits of doing so are numerous, especially for small businesses, only 50% of which survive past their first five years.

Removing ghost assets helps your business in the following ways:

- Adequate insurance coverage of the assets

- Streamlined and cost-effective annual updates

- Accurate accounting of assets for financial reporting

- Improved budgeting for future capital expenditure

- Identifies property tax saving opportunities

- Reduces insurance premiums

- Identifies and eliminates non-existent assets and optimizes return-on-asset ratios

What are the steps to removing ghost assets?

For some businesses, the process of removing ghost assets is easier said than done. Here’s a step-by-step process of how to remove ghost assets from your ledger, using an appraisal process:

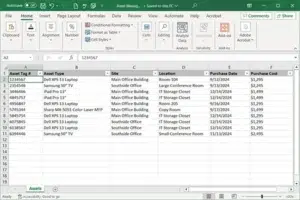

- Review current list of fixed assets. This is best done by using an automated asset management or tracking system, more on that below.

- Perform a physical audit of the assets. If you don’t already have an automated system, you must corroborate your ledger with what you physically have on hand in order to ensure the two lists match.

- Identify ghost assets and new asset additions. Ghost assets and their cousins, zombie assets, which do not appear on your books, but are for some reason present in your warehouse, office, or other work setting, should be easy to identify if a proper audit is done.

- Calculate FMV (fair market value) of audited assets. Figure out how much your assets should be worth, so you can depreciate them correctly on both your ledger and for your tax forms going forward.

- Finally, derive the benefits of your removal. The full list of benefits is above, but you’ll enjoy reduced property taxes, increased insurance coverage, and you’ll be on the right side of the law should an outside audit of your assets occur. Inaccurate asset reporting that is discovered by the IRS can lead to fines or other penalties.

How can businesses avoid accumulating ghost assets?

Once your books match your physical inventory, it’s imperative to continue avoiding the accumulation of ghost assets. If you’re a new business starting out, you can get ahead of the competition by instituting an inventory of fixed assets on a regular schedule.

TIP: Understand the different methods of asset depreciation to make the most of your investments and avoid tax issues.

|

In this day and age, it’s imperative to use asset tracking software to conduct your audits. Manual auditing is time-consuming and error-prone, while software makes identifying, finding and updating the location of all assets electronically a breeze, and a breeze if you become audited. With a comprehensive tracking system, you can immediately track the location and status of any fixed asset — the loss of those assets (due to either error or theft) is all but eliminated. You can also examine the asset’s transaction history and implement regularly scheduled maintenance in order to extend the useful life of your investments.

If you’re new to the process of asset management, be sure you know some of the process’s best practices, which includes ensuring accurate depreciation methods and, yes, properly eliminating the unneeded ghost assets that could cause you future headaches.

Considering that only 17% of companies have an asset management system in place to track their physical assets, it’s likely that your business needs to get to work on identifying ghost assets and ensuring they don’t bog down your books going forward. As bad as your ghost asset situation may be, it only gets worse the longer you let it go uncorrected.

Despite the name, ghost assets themselves are nothing to be afraid of, if you keep them in their place, tracking or removing and keeping the correct entry in your ledgers concerning these pesky pieces of property.

USA

UK

EUR