Managing fixed assets—the long-term pieces of property used in the production of income—is a challenge that grows exponentially as your company grows. Asset management is a responsibility that requires the best tools, systems, and practices in order to stay on top of things.

If you’ve been charged with tracking fixed assets, you’ll find that you need to be exceptionally conscientious and dedicated, since any challenges in fixed asset tracking could potentially lead to significant financial loss for your company and increased administrative burden on your part. You can also lead the company into tax and legal trouble if you’re not careful.

Keep in mind that the IRS isn’t just out to catch you defrauding the government—they have resources available that will actually help you save money. This article is about best practices you can use, so you can stay out of trouble and in the black.

Here are five ways that you can ensure your business’s assets remain safe, accounted for, in good working order, and in compliance. These are the best practices for good asset management:

1. ALWAYS USE THE BEST TOOLS FOR THE JOB

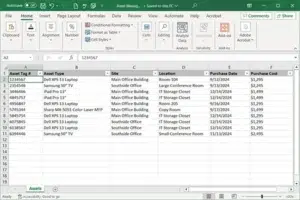

The software you use makes quite a bit of a difference in the accuracy of your asset management and how long it takes you to manage. Using older or legacy asset tracking systems will waste your time; it will be more difficult to maintain accurate asset records. Using the best tools will save you both time and money.

Incredibly, the majority of businesses polled by the Wasp Barcode State of Small Business Report said they don’t track assets or use manual processes to do so. Companies that still do hand counts or rely on spreadsheets are inviting tracking disasters.

In addition to having a reliable system, you also need it to be scalable. Your asset management system must have the ability to grow with your company; otherwise, you may find yourself in the awkward and delicate condition of having to move between asset tracking systems – with considerable cost.

At this stage, companies that do track assets are increasingly moving their systems to the cloud in order to keep everyone connected and all records synced. Quality asset tracking systems based in the cloud should still provide you with regular or custom reports, easy audits, triggered notifications, and centralized records—while not sacrificing the security of your data.

- ENSURE ACCURATE DEPRECIATION TRACKING

Without accurate tracking of asset depreciation, your company will pay too much for both taxes, insurance, and asset maintenance. Ideally, your asset management software should ensure accurate calculation of depreciation as long as your purchasing information is accurate.

Let’s talk first about maintenance. Knowing how your assets are depreciating can help you make more informed decisions about when to decommission an asset and when to invest in something new.

Take Excell Data, which provides IT project and consulting services throughout the United States. One of the most notable benefits they found when they switched to a mobile asset tracking solution was exactly how their assets were being used, and used up.

Here’s what Maurice Fuller, Executive Director of Operations for Excell, told Wasp about the company’s upgrade:

“We have real-time visibility into the status and location of our assets. We know where assets have been deployed, as well as the rate at which they are being repaired, returned and redeployed.”

“Plus, we have summary views that show how our various asset classes are aging and depreciating,” Fuller said. “With MobileAsset reports, it’s straightforward to make well-informed, strategic decisions to optimally manage our assets and maximize ROI.”

Some companies limp along on assets that are past their decommission date, while others operate blindly, swapping in new assets when they’re still paying taxes on old ones. Automated software takes the guesswork out of this importantly, costly part of running a business.

Financial and legal issues also arise from operating without management software: Failing to depreciate assets appropriately could lead to violations in regulatory compliance. This is especially true for companies that work with government funds or grants. Even when companies are not required to accurately report fixed assets to the government, they may have a duty towards board members and investors.

Being unable to accurately track depreciation of fixed assets could lead to skepticism regarding the accuracy of the books as a whole, and you may have to face down an IRS audit that will cost you financially.

- START YOUR TRACKING OUT RIGHT

Establishing a solid and accurate baseline is essential; if you begin with faulty numbers, your numbers will always be faulty. Never trust an old system. Go back to the physical inventory of your items to ensure they have all been cataloged and that they have been cataloged correctly.

Part of this involves removing “ghost” assets – which are assets that still exist on the books but are no longer company property. This could occur if the asset has been broken, stolen, or even sold but not properly recorded in your books. This will often occur due to improper tracking, either because the system is not accurate or because the procedures are not diligent enough.

Why is this an issue? For one, you’ll be paying taxes and/or insurance fees for an asset that you don’t even have. And secondly, you may think you have everything you need to complete a big upcoming order, just to suddenly find that you’re short a crucial asset.

There’s even such thing as “zombie” assets—assets that don’t appear on the books but are here in your warehouse or office space. How did that get here? It got here because you don’t have a handle on your asset management practices, and now you need to spend costly time and resources tracing the providence of this mystery piece of equipment.

4. STREAMLINE YOUR HARDWARE AND SOFTWARE

When managing your assets, you’ll need to have both the correct hardware and software, and you’ll need to ensure the two are well-integrated. They should work well in tandem without any compatibility issues.

Your hardware is just as important as the software component within your asset management system. You should be able to easily scan items with accuracy; this will improve your tracking overall.

Asset and inventory tracking are, for some reasons, areas where businesses feel they can ignore the technological revolution currently remaking the world. Automation and accountability are just two of the benefits you get when you upgrade your hardware and software in harmony.

- CUSTOMIZE YOUR FIXED ASSET REPORTING

Too often, companies rely on generic, boilerplate reports for their fixed asset reporting. Your schedule of fixed assets should be tailored both to your industry and your company; otherwise, it may be too difficult to glean any relevant and important information.

Go here to check out how to customize your field names, as well as some other helpful tips and tricks for using a mobile asset tracking system.

If you’re having issues tracking your fixed assets, it may be time to consider a better system. Wasp Barcode Technologies offers comprehensive hardware and software inventory tracking systems that can be integrated into or supplant existing asset management tracking. Contact us today to find out more about how our products can help you.

Whether you’re an enormous corporation like Amazon (and if so, hello, Jeff Bezos!) or a small business looking to become more efficient and cost-effective, look no further than your asset management practices as the best place to get started on making more money.

HOW ARE YOU TRACKING YOUR FIXED ASSETS TODAY? TELL US IN THE COMMENTS.

USA

UK

EUR